idaho estate tax exemption 2021

The tax is paid annually or semi-annually in December and June to your local county assessor. Transient personal property defined as transitory.

Idaho Inheritance Laws What You Should Know

The first 100000 of a businesss personal property is exempt from taxation.

. A 2021 law revised Idaho Code so that Idaho taxable income doesnt include a bonus depreciation add-back if the depreciation couldnt be used on the federal return. PROPERTY TAX EXEMPTIONS AVAILABLE IN IDAHO. The property applied for must be the.

There is a maximum exemption of 100000. The tax is then reduced by the available unified credit. Idaho has progressive state income tax rates that will range up to approximately 7.

You could reduce property taxes from 250 to 1500 on your home. Taxes are determined according to a propertys current market value minus any exemptions. Estates and taxes - Idaho State Tax Commission Estates and Taxes Idaho has no gift tax or inheritance tax and its estate tax expired in 2004.

In fact median home values and. A Homestead Exemption application can also be filled out online. You can get an application by emailing us or calling our office at 208 287-7200.

If youre a qualified Idaho homeowner you might be eligible for the Property Tax Reduction PTR program. Opponents contend that the new law will cut into basic services provided by local. The exemption affords homeowners a tax break of 50 of the houses value and up to one acre of land from property tax.

Property exempt from taxation Homestead. Does Idaho Have A Property Tax Exemption For SeniorsProgram called the Circuit Breaker lets Idahoans age 65 and older take a small break on their property taxes while the state takes. But seniors also can qualify for a property tax.

For more details on Idaho estate. For example homeowners of owner-occupied property may qualify for a partial exemption. Income Tax Return for Estates and Trusts.

1 For each tax year the first one hundred twenty-five. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special. The personal property exemption will increase from 100000 to a limit of 250000 per taxpayer per county.

The online application requires your parcel. With the homeowners exemption in Idaho capped at 100000 rising home values only mean rising tax burdens for your average homeowner. Contact your county assessor for additional program information and an application.

If the estate generates more than 600 in annual gross income you are required to file Form 1041 US. If youre a qualified Idaho homeowner you might be eligible for. Property tax exemptions are a discretionary incentive County Commissioners can offer business development projects which offer a significant economic impact to their communities.

Property taxes in Idaho are on the low side. An estate may also need to pay. For a property consisting of a home and one acre or less of land with a total assessed value of 250000 in 2021 the homeowners exemption would reduce the net taxable value to 125000.

Idaho Statutes are updated to the web July 1 following the legislative session. Available to residents of Idaho who own residential property in Idaho. Businesses get a boost in their property tax exemption from 100000 to 250000.

Idaho Estate Planning Home Facebook

Divorce Laws In Idaho 2021 Guide Survive Divorce

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Filing Final Tax Returns For The Deceased East Idaho Wealth Management

State Individual Income Tax Rates And Brackets Tax Foundation

Estate Tax Law Changes What To Do Now

Wills Trusts Estates Prof Blog

Oregon Estate Tax Everything You Need To Know Smartasset

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Don T Forget To Take State Estate Taxes Into Account

Idaho Estate Planning Home Facebook

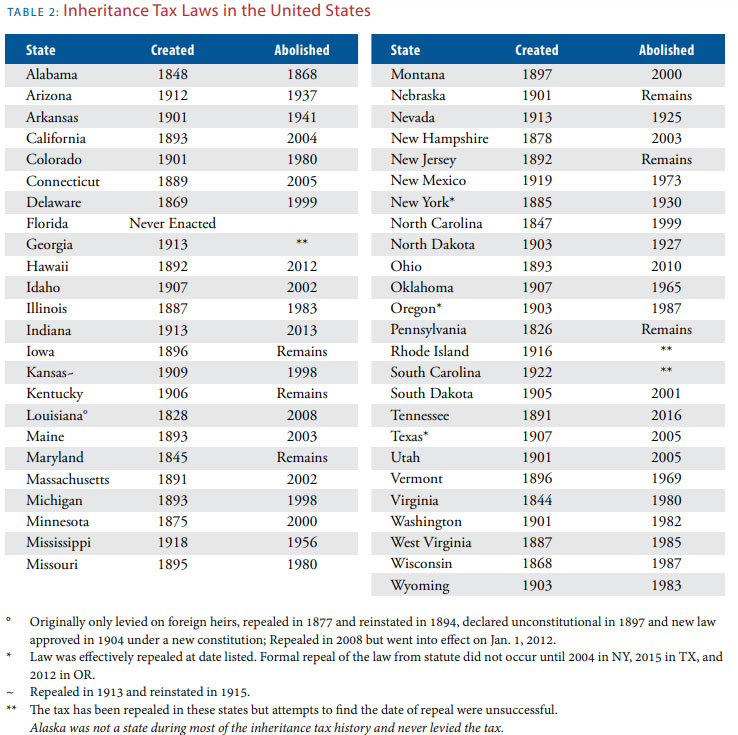

Death And Taxes Nebraska S Inheritance Tax

Idaho Estate Planning Home Facebook

Citing Impact On Farms Lawmakers Renew Calls To Repeal The Estate Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Where Not To Die In 2022 The Greediest Death Tax States

State Estate And Inheritance Taxes Itep

They Re Going To Tax Us Out Of Here Idaho Falls Residents React To Property Assessments Local News Postregister Com